Hey there, fellow entrepreneur! If you’re anything like I was when I first started navigating the world of business, you probably find insurance terms a bit like trying to solve a Rubik’s Cube blindfolded. Confusing, right? But here’s the thing: understanding your insurance is like building a strong foundation for your dreams. It protects everything you’ve worked so hard for.

I’m Shah Rukh, and after more than five years immersed in the nitty-gritty of insurance – helping countless businesses just like yours – I’ve seen firsthand how crucial it is to get this right. One of the biggest head-scratchers I encounter daily is the difference between Professional Liability and General Liability insurance. And trust me, it’s not just a fancy distinction; it’s about protecting your business from two very different, but equally real, types of risks.

So, grab a coffee, relax, and let’s demystify this together. By the end of this, you’ll feel confident about which one (or both!) your business needs. No jargon, just real talk and practical advice, straight from my experience to yours.

What is General Liability Insurance? (Your Business’s First Line of Defense)

Think of General Liability Insurance as your business’s everyday superhero. It’s the broad shield that protects you from common accidents and misfortunes that can happen to any business, regardless of your industry. It’s often referred to as Commercial General Liability Insurance, and it’s a foundational piece of any smart business protection plan.

Understanding Commercial General Liability Insurance

At its heart, general liability covers costs associated with claims that your business caused:

- Bodily Injury: Someone slips and falls on your premises (e.g., a client trips over a loose rug in your office, or a customer gets injured by a falling item in your retail store).

- Property Damage: You or your employee accidentally damages someone else’s property (e.g., a contractor’s ladder falls and breaks a client’s window, or during a client visit, you spill coffee on their expensive equipment).

- Advertising Injury: You’re accused of libel, slander, copyright infringement in your advertisements, or misappropriation of advertising ideas.

Shah Rukh’s Insight: I remember a client, a small café owner, who thought she was too small for “big business insurance.” Then, a customer slipped on a wet floor near the restroom, broke their wrist, and sued. Her general liability insurance for LLC saved her entire business from a devastating payout. This is why it’s often part of small business insurance requirements, especially if you interact with the public or visit client sites. It’s the peace of mind knowing everyday mishaps won’t sink your ship.

What is Professional Liability Insurance? (Protecting Your Expertise)

Now, if General Liability is your everyday superhero, then Professional Liability Insurance is your specialized expert, coming in when things get a bit more nuanced. This coverage steps in when your business is accused of making mistakes in the professional services you provide. It’s sometimes called Errors and Omissions (E&O) Insurance.

Diving into Errors and Omissions (E&O) Insurance

E&O insurance specifically covers claims related to professional negligence, errors, or omissions in the services you render. This includes:

- Mistakes or Negligence: You make an error or oversight in your professional advice or service that causes a client financial loss.

- Failure to Deliver Services: You don’t perform a service as promised, or fail to meet a deadline, leading to client damages.

- Bad Advice: Your professional advice leads to negative consequences for your client.

Shah Rukh’s Insight: I once helped a graphic designer who accidentally used a copyrighted font in a client’s logo, resulting in a hefty cease-and-desist letter. The client sued for damages and redesign costs. His professional liability insurance coverage (his E&O policy) stepped in and handled the legal defense and settlement. This is why professional liability insurance for consultants, accountants, IT professionals, real estate agents, and many others in service-based fields is not just good practice, it’s essential.

Professional Indemnity vs Public Liability (Quick Clarification)

You might have heard the terms “Professional Indemnity” and “Public Liability,” especially if you’re looking at insurance outside the US. In essence:

- Professional Indemnity (PI) is generally the UK/Commonwealth equivalent of Professional Liability (E&O) in the US. It covers claims of professional negligence.

- Public Liability is often the UK/Commonwealth equivalent of General Liability in the US. It covers bodily injury or property damage to third parties.

So, if you hear these terms, remember they often refer to the same core protections, just with different names depending on where you are!

The Big Difference: Why Can’t One Policy Do It All?

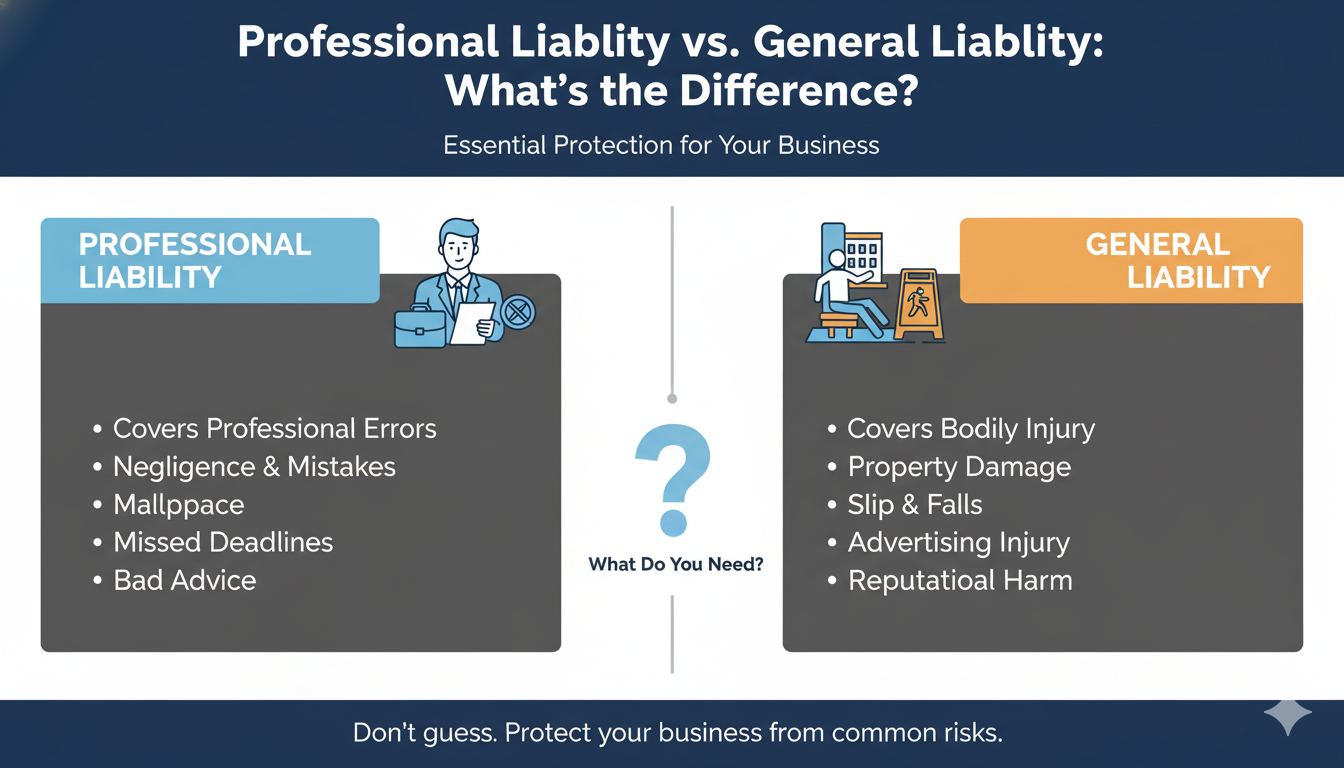

This is the core of the confusion, and it boils down to the nature of the risk each policy addresses.

- General Liability: Covers physical accidents, injuries, and property damage that are often unforeseen and not directly tied to the quality of your professional advice or service. Think of it as “oops, an accident happened.”

- Professional Liability (E&O): Covers financial damages arising from mistakes, errors, or negligence in the professional services you provide. Think of it as “oops, my professional judgment or work led to a problem.”

Shah Rukh’s Insight: I explain it like this to my beginner friends: Imagine you’re a web designer. If a client trips over your laptop cord in your office and breaks their arm, that’s a General Liability issue. If you accidentally delete their entire website database because of a coding error, and they lose thousands in sales, that’s a Professional Liability (E&O) issue. Two very different scenarios, both potentially devastating, and needing different shields.

Who Needs What? A Practical Guide

It’s not about choosing one over the other in many cases; it’s about understanding your specific business risks.

When You Definitely Need General Liability

If your business:

- Operates out of a physical location that clients or the public visit.

- Visits client sites for work (e.g., electricians, plumbers, consultants who meet clients in person).

- Advertises its services or products.

- Has employees.

Essentially, almost every business that interacts with the public, has a physical presence, or does work on someone else’s property needs general liability. It’s usually the first insurance policy any new business owner should consider. Many vendors, landlords, and clients will require you to carry it before doing business, especially for best business insurance for contractors.

When You Absolutely Need Professional Liability

If your business offers professional advice or services, you likely need Professional Liability. This includes:

- Consultants (IT, marketing, business, HR)

- Accountants and Bookkeepers

- Web Designers & Developers

- Real Estate Agents

- Architects & Engineers

- Financial Advisors

- Therapists & Counselors

- Marketing Agencies

If a client could claim they lost money because of your professional advice, recommendations, or work product, professional liability insurance for consultants and other service providers is your safety net. This is where errors and omissions insurance vs general liability becomes a critical distinction.

Many Businesses Need Both!

This is a crucial takeaway! Most businesses that provide professional services *and* have a physical presence or interact with clients in person will need both policies. For example, a marketing consultant who meets clients at their office needs General Liability for the potential slip-and-fall, AND Professional Liability for any bad campaign advice.

Understanding Costs and Coverage Limits

Let’s talk money, because that’s always a big question mark. The cost of errors and omissions insurance and general liability varies widely, but it’s an investment, not just an expense.

Professional Liability Insurance Cost & Coverage

The professional liability insurance cost depends on several factors:

- Your Industry: Some professions are considered higher risk than others (e.g., financial advisors vs. graphic designers).

- Your Business Size & Revenue: Larger businesses with more clients and higher revenue often pay more.

- Claims History: A history of past claims can increase your premium.

- Coverage Limits: The higher your professional liability insurance coverage limits (e.g., $1 million vs. $250,000), the higher the cost.

- Deductible: A higher deductible can lower your premium, but means you pay more out-of-pocket if a claim occurs.

Don’t just jump at the lowest quote; ensure the professional liability insurance coverage genuinely protects you based on your specific services and potential risks.

General Liability Insurance Quotes & Coverage

Similarly, when you’re looking for general liability insurance quotes, factors like these will influence the price:

- Your Industry: A construction business will likely pay more than a virtual assistant.

- Business Location: Urban areas with higher traffic or specific regional risks might see different rates.

- Number of Employees: More employees generally mean more risk.

- Coverage Limits: Higher general liability insurance coverage limits will increase the premium.

It’s about finding the right balance of protection and affordability. Always get a few general liability insurance quotes to compare.

Making the Smart Choice: Business Insurance Comparison

Navigating the options can feel overwhelming, but you’re not alone. I’ve spent years helping people through this exact process, and I promise you, it’s worth the effort.

Getting Business Liability Insurance Quotes Online

The good news is that getting business liability insurance quotes online has never been easier. Many reputable insurers and brokers offer instant quotes based on some basic information about your business. This is a great starting point for your commercial insurance policy comparison.

Commercial Insurance Policy Comparison Tips

- Don’t Just Look at Price: The cheapest policy isn’t always the best. Look at what’s covered (and what’s excluded!).

- Understand Your Limits: Are the general liability insurance coverage limits and professional liability insurance coverage adequate for your potential risks? Consider your client contracts – some might require specific limits.

- Read the Fine Print: Seriously, ask questions about deductibles, exclusions, and how claims are handled.

- Seek Expert Advice: A good insurance broker (like, well, me!) can be invaluable. They understand the nuances of business insurance comparison and can tailor solutions to your unique situation.

Shah Rukh’s Advice: Don’t try to guess what you need. From my experience, the cost of being underinsured or having the wrong type of insurance far outweighs the premium. It’s a small recurring cost that protects your entire livelihood. Invest in peace of mind.

Quick Comparison Table: Professional vs. General Liability

Here’s a quick glance at the key differences we’ve discussed, making your errors and omissions insurance vs general liability comparison even clearer:

| Feature | General Liability Insurance | Professional Liability Insurance (E&O) |

|---|---|---|

| Primary Purpose | Protects against everyday physical accidents and injuries. | Protects against claims of professional errors or negligence. |

| What it Covers | Bodily injury, property damage, advertising injury. | Mistakes, negligence, omissions, bad advice in professional services. |

| Type of Harm | Physical harm, property damage, reputational harm from advertising. | Financial loss to client due to your professional service/advice. |

| Example Claim | Client slips on wet floor in your office. | Client sues because your advice led to their financial loss. |

| Who Needs It (Generally) | Almost any business that interacts with the public or operates physically. | Service-based businesses offering advice or expertise. |

| Other Names | Commercial General Liability, Public Liability (UK/AU). | Errors & Omissions (E&O), Professional Indemnity (UK/AU). |

Conclusion: Protecting Your Passion and Future

Phew! We’ve covered a lot, haven’t we? But now you’re armed with crucial knowledge about Professional Liability vs. General Liability. Understanding this distinction isn’t just about jargon; it’s about building a resilient, protected business.

You work incredibly hard to build your business, and it’s truly commendable. Don’t let a misunderstanding about insurance leave you vulnerable. While it might seem like a daunting task to get it all sorted, remember that every successful entrepreneur has to face these critical decisions. You’re making smart choices by educating yourself right now!

My honest advice? Don’t leave your business’s future to chance. Take this newfound understanding and apply it. If you’re still feeling unsure about your specific needs or want help navigating the best options, don’t hesitate to reach out to an insurance professional. They can provide personalized business insurance comparison and guide you through getting the most competitive business liability insurance quotes online tailored for you.

Your business is your dream – let’s make sure it’s well-protected!