Hey there, fellow business owner!

It’s Shah Rukh here, and if there’s one thing I’ve learned in my 5+ years of navigating the ins and outs of business insurance, it’s this: running a business is a rollercoaster of triumphs, challenges, and sometimes, unexpected curveballs. You pour your heart and soul into building something great, and the last thing you want is a single unforeseen event to derail all that hard work.

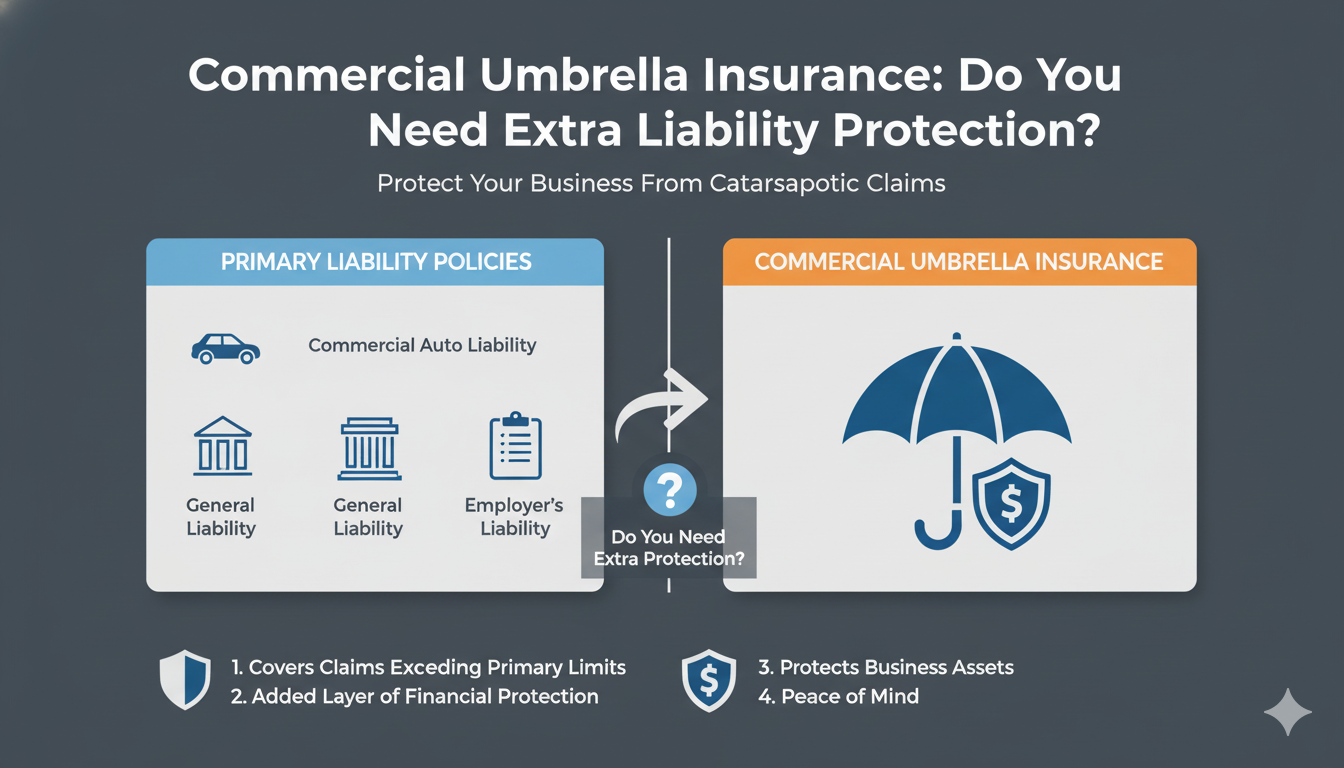

We all have our primary safety nets – our general liability, auto, and professional liability policies. They’re fantastic, essential even. But sometimes, even the best safety net isn’t quite enough when the fall is steeper than anyone anticipated. That’s where a silent guardian, a true superhero of the insurance world, steps in: Commercial Umbrella Insurance.

When I first started in this industry, a lot of business owners (myself included, in my early ventures!) would look at me and say, “Shah Rukh, do I really need extra liability protection? Isn’t my existing policy enough?” And trust me, I get it. Every dollar counts when you’re growing a business. But what if I told you that this “extra” layer isn’t just a luxury, but often a necessity for true peace of mind? Let’s dive in and unpack why.

What Exactly is Commercial Umbrella Insurance? Think of it as Your Business’s Extra-Large Raincoat

Imagine this: you’re walking outside, and you have a perfectly good umbrella. It covers you well. But then, a sudden, torrential downpour hits – wind blowing, rain coming in sideways. Your regular umbrella just isn’t cutting it. You wish you had a giant, all-encompassing raincoat that would protect you from every angle.

That’s essentially what commercial umbrella insurance does for your business. It’s an additional layer of liability coverage that kicks in *after* the limits of your primary policies (like commercial general liability, commercial auto liability, or even employer’s liability) have been exhausted. It’s designed to protect your business from catastrophic claims or lawsuits that could otherwise bankrupt you.

It often gets called business excess liability insurance, and for good reason! It provides that crucial “excess” protection when your underlying policies hit their maximum payout. It’s not about replacing your existing coverage; it’s about amplifying it, making sure you’re protected when the stakes are incredibly high.

Why Your Business Might Need This Extra Shield – Shah Rukh’s “What If” Scenarios

In my years of helping businesses, big and small, secure their futures, I’ve seen firsthand how quickly a seemingly minor incident can snowball into a multi-million dollar claim. It’s easy to think, “That won’t happen to me.” But life, and business, have a way of throwing curveballs.

The “What Ifs” – Real-Life Scenarios Where an Umbrella Policy Shines

Let’s talk real-world examples. These are the kinds of situations that keep business owners up at night:

- The Unfortunate Slip-and-Fall: Imagine you own a popular restaurant. A customer slips on a wet floor, breaks their hip, and faces extensive medical bills and lost wages. Your commercial general liability umbrella might have a $1 million limit. But what if the lawsuit awards them $2 million? Without a commercial umbrella policy, your business would be on the hook for that extra million. This is a common concern for businesses needing commercial umbrella insurance for restaurants or even commercial umbrella insurance for rental properties where tenants or guests can get injured.

- The Major Auto Accident: If you run a delivery service or a trucking company, your vehicles are constantly on the road. A serious accident involving one of your drivers could lead to severe injuries or fatalities, and the resulting legal settlements or judgments could quickly exceed your commercial auto liability limits. For commercial umbrella insurance for trucking companies, this is paramount.

- The Contractor Catastrophe: A contractor’s mistake on a job site leads to significant property damage or injury to a third party. Their general liability policy might cover a good portion, but complex construction claims can easily surpass primary limits. This is why commercial umbrella insurance for contractors is practically non-negotiable in today’s litigious environment.

- The Professional Blunder (Yes, Even for Professionals!): While less common for professional liability, some umbrella policies can extend over your professional liability. If you’re a consultant and your advice leads to massive financial losses for a client, an ordinary professional liability umbrella insurance might not kick in, but some broader commercial umbrellas can offer an extra layer of defense against truly devastating claims if structured correctly.

Protecting Your Assets & Future

It’s not just about paying a claim. It’s about protecting everything you’ve built. Without sufficient liability coverage, a major lawsuit could:

- Force you to liquidate business assets.

- Tap into your personal assets if your business structure (like an LLC) isn’t fully protecting you.

- Lead to years of legal battles and financial strain.

- Even force you to close your doors permanently.

An umbrella policy is your firewall against these worst-case scenarios, ensuring your business’s longevity and your personal financial security.

Is Commercial Umbrella Insurance Different from Excess Liability? Let’s Clear the Air!

This is a common question I get, and it’s a good one! People often use the terms interchangeably, and while they are very similar and both provide coverage above existing limits, there’s a subtle but important distinction that can make a huge difference in specific situations.

Here’s a quick comparison to help you understand the core difference between umbrella insurance vs excess liability:

| Feature | Commercial Umbrella Insurance | Excess Liability Insurance |

|---|---|---|

| Scope of Coverage | Broader. Can provide additional coverage over multiple underlying policies (General Liability, Auto Liability, Employer’s Liability) AND potentially “drop down” to cover gaps where underlying policies might not. | Narrower. Typically provides additional coverage over a *single* specific underlying policy (e.g., just your General Liability). It “follows form” of the primary policy, meaning it has the exact same terms and conditions. |

| “Drop-Down” Feature | Yes, can sometimes cover claims not covered by underlying policies (after a self-insured retention or deductible is met). | No, generally does not drop down. Only applies when the underlying policy’s limits are exhausted for a covered claim. |

| Types of Policies Covered | General Liability, Auto Liability, Employer’s Liability, sometimes others. | Usually designed for one specific underlying policy. |

| Cost (General) | Can be slightly more complex in pricing due to broader coverage. | Often simpler to price as it mirrors the underlying policy. |

So, while both add “extra” coverage, the umbrella truly acts like a broader, more flexible safety net, ready to catch you from more angles. This is why for most businesses, a commercial umbrella policy is the preferred choice for comprehensive protection.

Who Benefits Most from a Commercial Umbrella Policy?

While I genuinely believe nearly every business can benefit, some businesses absolutely *need* this type of coverage. In my experience, it’s not just about size, but about exposure.

High-Risk Industries

If your business involves higher inherent risks, heavy equipment, frequent public interaction, or extensive travel, an umbrella policy is non-negotiable. This includes:

- Contractors and Construction Companies: From small remodelers to large commercial builders, the risk of accidents, injuries, or property damage is always present. Commercial umbrella insurance for contractors provides a crucial safety net.

- Trucking and Transportation Companies: The potential for catastrophic auto accidents means high liability exposure. Commercial umbrella insurance for trucking companies can be the difference between survival and closure after a major incident.

- Restaurants and Hospitality: High foot traffic, food preparation, alcohol service, and sometimes entertainment all increase liability risks. Don’t skimp on commercial umbrella insurance for restaurants.

- Property Owners & Managers: If you own commercial properties or even residential ones for rent, you’re constantly exposed to slip-and-fall claims, tenant issues, or other premises liability. Consider commercial umbrella insurance for rental properties.

- Manufacturers and Distributors: Product liability claims can be immense if a defect causes injury or damage.

Businesses with Significant Assets

The more assets your business has, the bigger target you might be for lawsuits. A large judgment could wipe out years of profit and hard-earned capital. An umbrella policy protects those assets.

Growing Businesses & LLCs

As your business expands, so does your exposure. More employees, more clients, more operations – all equal more risk. Even if you’ve structured your business as an LLC (Limited Liability Company), while it offers some personal asset protection, it doesn’t make your business immune to massive lawsuits. A robust commercial umbrella insurance for LLC structure ensures your business entity itself is protected from catastrophic claims.

Understanding Commercial Umbrella Policy Limits & Cost

When discussing insurance, the conversation always turns to two things: how much coverage and how much it costs. My advice, as Shah Rukh the insurance guru, is always this: don’t just think about what you *can* afford, think about what you *might* need to truly protect your business.

What are Typical Commercial Umbrella Policy Limits?

Commercial umbrella policy limits typically start at $1 million and can go up to $5 million, $10 million, or even higher for very large corporations. For many small to medium-sized businesses, a $1 million to $5 million policy is a common and wise choice. If you’re wondering about a 5 million dollar umbrella policy cost, it’s often more affordable than you’d think, especially when you weigh it against the potential cost of an uninsured loss.

These limits sit atop your underlying policies. So, if you have a $1 million commercial general liability umbrella policy and a $2 million umbrella policy, you effectively have $3 million in total coverage for a covered claim.

What Influences Commercial Umbrella Insurance Cost?

The commercial umbrella insurance cost isn’t a one-size-fits-all number. Several factors come into play:

- Your Industry and Risk Exposure: High-risk industries (like construction or trucking) will generally pay more than, say, a low-risk consulting firm.

- Your Claims History: A history of frequent or large claims will likely increase your premiums.

- The Limits of Your Underlying Policies: The higher your primary policy limits, the less likely the umbrella policy is to be tapped, which can sometimes lead to slightly lower umbrella premiums.

- The Umbrella Policy Limit You Choose: More coverage naturally means a higher premium.

- Geographic Location: States with more litigious environments might see higher rates.

While searching for cheap commercial umbrella insurance is natural, remember that the goal is adequate protection, not just the lowest price. A good insurance agent can help you use a business umbrella insurance coverage calculator (or similar tools) to estimate what you might need based on your specific business profile.

How to Get the Best Commercial Umbrella Insurance for Your Business

Getting the right coverage shouldn’t feel like a chore. Here’s Shah Rukh’s straightforward guide to securing that vital extra layer of protection:

Assess Your Risk Profile

Before you even look at quotes, take an honest look at your business. What are your biggest exposures? Do you interact with the public? Do you have employees? Do you use vehicles? What’s the worst-case scenario you can imagine? Understanding your unique commercial umbrella insurance requirements is the first step.

Compare Commercial Umbrella Insurance Quotes

This is where smart shopping comes in! Don’t just go with the first offer. Reach out to multiple commercial umbrella insurance companies. Look for commercial umbrella insurance quotes from various providers. Many providers now offer excess liability insurance quotes online, making it easier than ever to get multiple options and perform a thorough business liability insurance comparison.

Remember, the “best” policy isn’t always the cheapest. It’s the one that offers the most comprehensive coverage for your specific needs at a competitive price.

Work with an Expert (Like Me!)

Seriously, an independent insurance agent who specializes in business insurance is invaluable. We can help you:

- Identify your true risk exposures.

- Navigate the complexities of different policies.

- Compare offerings from various commercial umbrella insurance companies to find the best commercial umbrella insurance for small business, contractors, restaurants, or any other niche.

- Ensure your primary policies meet the requirements for an umbrella policy to kick in.

It’s about having a trusted advisor who understands your business as well as they understand insurance.

Shah Rukh’s Final Thoughts: It’s About Peace of Mind

You’ve worked incredibly hard to build your business, to serve your customers, and to create opportunities. Don’t let a single, unforeseen disaster wipe it all away. Commercial umbrella insurance isn’t just another policy; it’s an investment in your business’s resilience, your financial stability, and most importantly, your peace of mind.

I’ve seen too many businesses falter because they underestimated the potential cost of a major lawsuit. Don’t be one of them. Take control of your future by securing the protection you deserve. It allows you to focus on growth, innovation, and doing what you do best, without the constant worry of a catastrophic liability claim looming over your head.

Conclusion: Are You Ready for Extra Liability Protection?

So, do you need extra liability protection? In almost every scenario for a growing, thriving business, my answer is a resounding YES. Commercial umbrella insurance acts as your ultimate financial bodyguard, standing by when your primary policies reach their limits.

It’s not just a smart business decision; it’s a confident one. Take the next step today – get those commercial umbrella insurance quotes, chat with an expert, and ensure your business is fully prepared for whatever challenges come its way. Your future self (and your balance sheet) will thank you!