Hey there, fellow dreamers and entrepreneurs! Shah Rukh here, your friendly neighborhood insurance expert (and a human blogger, just like you!). I’ve spent over five years navigating the sometimes-confusing world of insurance, from helping folks protect their cars to safeguarding their biggest business ventures. And let me tell you, one of the most common questions I get asked, especially these days, is about home-based businesses.

You’ve got a fantastic idea, you’re working hard from your home office, and things are starting to take off. Maybe you’re crafting bespoke jewelry, offering digital marketing services, running an e-commerce store, or consulting from your cozy corner. It’s exciting, right? But then a little voice creeps in, usually around 2 AM: “Does my trusty homeowner’s policy actually cover my home-based business?”

It’s a crucial question, and honestly, it’s one you CANNOT afford to get wrong. I’ve seen too many well-meaning entrepreneurs get a rude awakening when something goes awry. So, let’s dive deep, with no jargon and plenty of empathy, to get you the answers you need.

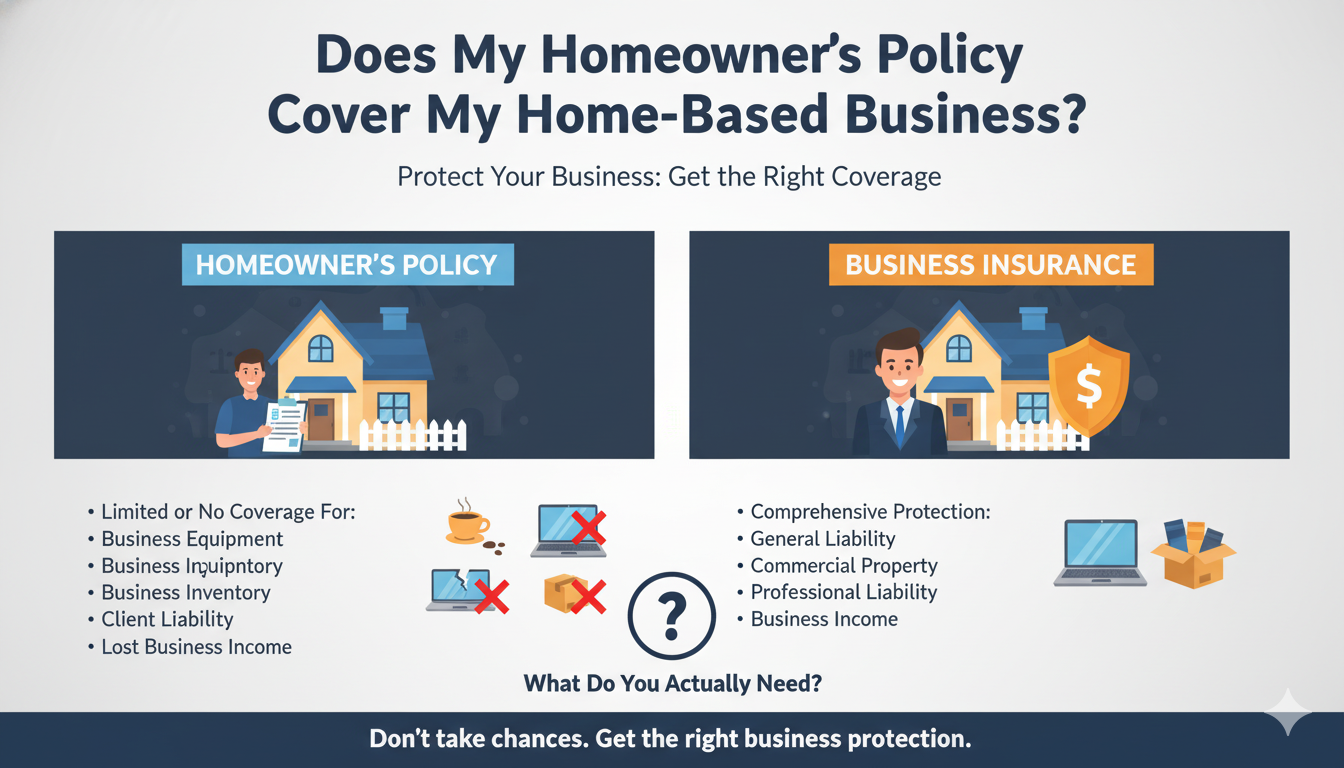

The Big Question: Does My Homeowner’s Policy Cover My Home-Based Business?

Let’s cut straight to the chase because I believe in honest, direct advice, just like I’d give to a friend over a cup of chai.

The Short Answer (and Why It’s Often “No”)

For most home-based businesses, the short answer is: Not sufficiently, and sometimes, not at all.

Your homeowner’s insurance policy is a beautiful thing, designed to protect your personal home and belongings from typical residential risks – think fires, theft, a guest slipping on your porch. It’s built for *personal* use, not *commercial* operations.

Think of it this way: If your friend comes over for dinner and trips on your rug, your homeowner’s liability might kick in. But if a client visits your home office for a meeting, slips on the same rug, and decides to sue you for medical expenses and lost wages? Your homeowner’s policy will likely say, “Sorry, that’s a business risk, not a personal one.” I’ve seen this exact scenario play out, and it’s heartbreaking when a small business owner is left exposed.

Some policies *might* offer a tiny sliver of coverage for business property (like a laptop or printer) or very limited liability, usually under specific, very low limits (e.g., $2,500 for equipment, or only if your business income is extremely minimal). But this is rarely enough to protect your growing venture.

Where Homeowners Insurance Falls Short for Home-Based Businesses

Let’s break down the gaps:

- Limited Business Property Coverage: Your homeowner’s policy might cover your personal laptop, but what about your specialized crafting equipment, your inventory of handmade soaps, or your professional photography gear worth thousands? Standard policies typically offer very little, if any, coverage for business-specific items.

- No Commercial General Liability Protection: This is a big one. If a client gets injured on your property, if you accidentally damage a client’s property, or if there’s a claim of advertising injury (like libel or slander), your homeowner’s policy will almost certainly deny coverage. This is where commercial general liability insurance quotes become essential.

- Exclusions for Professional Services: If your business involves giving advice, consulting, or providing a service (e.g., graphic design, accounting, life coaching), your homeowner’s policy offers zero protection for claims of professional negligence, errors, or omissions. This is a massive blind spot for many service-based businesses.

- No Business Interruption Coverage: What happens if a fire or flood makes your home office unusable for weeks? Your homeowner’s policy might help repair your home, but it won’t replace the income your business loses during that downtime.

- No Workers’ Compensation: If you hire employees, even part-time or seasonal help who work from your home, your homeowner’s policy doesn’t cover their work-related injuries or illnesses. You’ll need specific workers compensation for home employees.

- Limited Cyber Protection: If you handle client data, process online payments, or rely heavily on your website, a cyberattack or data breach could be catastrophic. Homeowner’s policies offer no protection here.

What Are My Options? Protecting Your Home-Based Dream

Okay, so your homeowner’s policy isn’t enough. Don’t panic! This is where smart planning comes in. You have several options, ranging from basic add-ons to comprehensive business policies.

Option 1: The Homeowners Insurance Business Endorsement (The “Rider”)

If your home-based business is very small, part-time, and low-risk (think hobby-level income with no client visits or product sales), an in-home business insurance rider or homeowners insurance business endorsement might be a starting point. This is an add-on to your existing homeowner’s policy.

- What it does: It typically increases the coverage limits for business property (like your computer and tools) and might offer a small amount of liability protection for very specific, low-risk business activities.

- When it might be suitable: For extremely small operations with minimal revenue, no employees, and no direct public interaction.

- Limitations: This is NOT a full business insurance policy. It still has significant limits on property and liability, rarely covers professional errors, and won’t cover product liability or cyber risks. It’s a band-aid, not a robust solution.

Option 2: Standalone Business Insurance Policies (The Real Deal)

For most serious home-based businesses, standalone policies are the way to go. This is where you get robust protection tailored to your unique risks. Think of these as the sturdy pillars holding up your business dreams:

- Business Owners Policy (BOP): Often the best starting point for many small businesses. A BOP bundles two essential coverages:

- Commercial Property Insurance: Protects your business equipment, inventory, furniture, and supplies from perils like fire, theft, and vandalism. This is your commercial property insurance for home office.

- Commercial General Liability (CGL) Insurance: Covers claims of bodily injury (e.g., a client slipping at your home), property damage (e.g., you accidentally damage a client’s item), and personal/advertising injury (e.g., libel, slander). When looking for coverage, get some commercial general liability insurance quotes to compare.

The business owners policy BOP cost is often more affordable than buying these policies separately.

- Professional Liability Insurance (Errors & Omissions – E&O): If you offer advice, services, or expertise, this is non-negotiable. It protects you from claims of negligence, errors, or omissions in your professional services that cause a client financial loss. This is your professional liability insurance for home business. For instance, if you’re a consultant, this is your errors and omissions insurance for consultants.

- Product Liability Insurance: If you design, manufacture, or sell physical products from your home, this is vital. It covers claims of injury or property damage caused by a defect in your product. Crucial for any artisan, crafter, or e-commerce seller – look into product liability insurance for home based business.

- Cyber Liability Insurance: In our digital age, this is increasingly important. It helps cover costs associated with data breaches, cyberattacks, and other cyber risks, including notification costs, legal fees, and reputational damage. Essential for anyone handling customer data or operating online – consider cyber liability insurance for small business.

- Workers’ Compensation Insurance: If you have any employees, even if they work remotely or part-time from your home or theirs, you’ll likely need this by law. It covers medical expenses and lost wages for work-related injuries or illnesses. This is your workers compensation for home employees.

Finding the right combination of business insurance for home based business policies might seem daunting, but it’s an investment in your peace of mind and the longevity of your venture.

Finding the Right Fit: Practical Tips from Shah Rukh

As someone who’s seen the good, the bad, and the ugly of insurance claims, here are my personal tips to help you navigate this process:

Assess Your Risks Honestly

Sit down and really think about your business. Be brutally honest with yourself.

- What do you do? Are you a consultant, a baker, a web designer, a reseller?

- Do clients visit your home? If so, liability is a bigger concern.

- Do you ship products? If so, product liability is crucial.

- Do you handle sensitive customer data (credit cards, personal info)? Cyber liability is a must.

- Do you rely on expensive equipment or significant inventory? Property coverage is key.

- Do you give advice or provide expert services? Professional liability is essential.

This self-assessment is the first, most important step in finding the right coverage.

Don’t Just Get One Quote – Compare!

Just like you wouldn’t buy the first car you see, don’t settle for the first insurance quote. Different insurers specialize in different types of businesses and offer varying rates. Make sure to compare home business insurance quotes from several providers. You can often find great deals, and it pays to look for small business insurance rates 2025 to get an idea of current market pricing.

Understand Your Policy (and Ask Questions!)

Insurance policies can be dense. Don’t be afraid to ask your agent to explain every detail, especially what’s covered and, more importantly, what’s *excluded*. I always tell my friends: there’s no such thing as a silly question when it comes to protecting your livelihood.

Consider Your Business Structure

If you’ve formed an LLC, congratulations! That offers some personal asset protection, but it doesn’t replace the need for business insurance. In fact, many clients and partners will require you to have insurance if you’re an LLC. Researching best business insurance for LLC specifically can help you tailor your coverage.

| Feature | Standard Homeowner’s Policy | Home Business Endorsement (Rider) | Standalone Business Insurance (e.g., BOP) |

|---|---|---|---|

| Business Property Coverage (e.g., equipment, inventory) | Very limited (e.g., $500 – $2,500), if any. Designed for personal items. | Modestly increased limits (e.g., $5,000 – $10,000), but still limited. | Robust coverage tailored to actual business asset value. |

| Business Liability (e.g., client injury on property, property damage) | Generally excluded or extremely limited for business activities. | Very basic and limited liability for specific, low-risk business activities. | Comprehensive Commercial General Liability (CGL) coverage. |

| Professional Liability (Errors & Omissions) | No coverage. | No coverage. | Specific policy (E&O) available for service-based businesses. |

| Product Liability | No coverage. | No coverage. | Specific policy available for businesses selling products. |

| Business Interruption | No coverage. | No coverage. | Often included in BOPs or as an add-on. |

| Cyber Liability | No coverage. | No coverage. | Specific policy available. |

| Workers’ Compensation | No coverage for employees. | No coverage for employees. | Specific policy available if you have employees. |

| Cost Effectiveness | “Free” (included in homeowner’s, but ineffective). | Low additional cost. | Higher cost, but provides adequate protection for actual business risks. |

What About the Cost? (Home Based Business Insurance Cost)

I know, I know. Another expense when you’re trying to grow your business can feel daunting. But view home based business insurance cost not as an expense, but as an investment. It’s an investment in your peace of mind, your financial security, and the future of your dream.

The cost will vary widely based on:

- The type of business you run (a freelance writer’s insurance will differ from a custom furniture maker’s).

- Your industry and associated risks.

- Your desired coverage limits and deductibles.

- Your business structure and revenue.

- The insurance provider.

A basic BOP for a low-risk home-based business might be surprisingly affordable, often starting from a few hundred dollars a year. Adding specialized coverage like professional liability or cyber insurance will increase the premium, but the protection it offers in case of a claim is invaluable compared to the potential costs of a lawsuit or business disruption.

Remember, one major claim without adequate insurance could easily wipe out years of hard work and savings. It’s a risk just not worth taking.

Conclusion: Protect Your Passion, Secure Your Future

Running a home-based business is an incredible journey, full of passion, hard work, and the joy of building something of your own. Don’t let a misunderstanding about insurance turn your dream into a nightmare.

Your homeowner’s policy is designed for your home life, not your business life. To truly protect your hard work, your assets, and your financial future, you need dedicated business insurance for home based business.

My honest advice? Don’t guess, don’t assume, and definitely don’t procrastinate. The best next step you can take for your home-based business today is to:

Talk to an independent insurance agent who specializes in small business insurance. They can assess your specific risks, explain your options (like a BOP, professional liability, or a home business rider), and help you compare home business insurance quotes to find the right coverage at a price that works for you. Invest a little time now, and save yourself a world of potential heartache later.

You’ve got this! Keep building, keep dreaming, and keep protecting that amazing venture of yours. I’m rooting for your success!