If you’re reading this, chances are you’ve stared at insurance forms, heard terms like “full coverage” and “liability,” and felt a little swirl of confusion in your head. Maybe you’ve even thought, “Do I *really* need all this?” Trust me, you’re not alone. As Shah Rukh, an insurance expert with over five years of navigating these waters (and admittedly, a few fender benders in my younger days!), I’ve seen firsthand how bewildering it can be to choose the right car insurance. But it doesn’t have to be.

My goal today is to break down the big decision between Full Coverage vs. Liability Insurance in a way that feels like we’re just having a friendly chat over coffee. No confusing jargon, just honest advice and practical insights to help you decide what you *actually* need to protect yourself, your car, and your wallet.

Ready to demystify car insurance? Let’s dive in!

Car Insurance 101: Why Do We Even Need It?

Before we compare, let’s quickly touch on the ‘why.’ Car insurance isn’t just another bill; it’s a financial safety net. Imagine an unexpected accident – someone gets hurt, cars are damaged. Without insurance, you could be facing astronomical bills that could bankrupt you. Most states mandate minimum insurance coverage precisely for this reason: to ensure that if you cause an accident, the victims have some recourse for their medical bills and property damage.

Think of it as peace of mind, not just a legal requirement. It’s about protecting your future.

Liability Insurance: The Bare Minimum (And Why It Might Be Enough For Some)

Let’s start with the basics: Liability insurance. This is what nearly every state requires you to have. When people talk about state minimum car insurance requirements, they’re usually talking about liability.

What Does Liability Insurance Actually Cover?

Simply put, liability insurance covers damage you cause to *other people and their property* in an accident where you are at fault. It has two main components:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for anyone you injure in an accident.

- Property Damage Liability: This pays for repairs or replacement of another person’s car or property (like a fence, mailbox, or building) that you damage.

The “Shah Rukh” Take on Liability:

When I was a young driver, fresh out of college, my first car was an old, trusty sedan – more rust than shine, but it got me from A to B. I figured, “It’s not worth much, so why spend a fortune on insurance?” I opted for liability only, and frankly, it felt like a smart move for my limited budget. I could easily buy liability car insurance online and found quite a few affordable options.

Pros of Liability Insurance:

- Cheaper Premiums: It’s almost always the most affordable option, helping you meet legal requirements without breaking the bank.

- Meets Legal Requirements: Keeps you legal on the road.

Cons of Liability Insurance:

- No Coverage for Your Car: This is the big one. If you’re at fault, your liability insurance will NOT pay for damages to your own vehicle. You’ll be footing the bill for repairs or replacement.

- No Coverage for Your Injuries: Similarly, your medical bills won’t be covered by your liability policy if you’re the one who caused the accident.

- Limited Protection: State minimums are often quite low and might not be enough to cover severe accidents, leaving you personally responsible for the difference.

Who Might Benefit from Liability-Only Coverage?

- Drivers with Older, Low-Value Cars: If your car isn’t worth much, the cost of full coverage might outweigh its actual value.

- Drivers with Significant Savings: If you have a hefty emergency fund and could easily afford to repair or replace your car out-of-pocket, liability might be sufficient.

- Very Safe Drivers (but remember, accidents happen!): Even the best drivers can’t control what others do on the road.

Full Coverage Insurance: The Ultimate Peace of Mind (But What Does “Full” Really Mean?)

The term “full coverage” is a bit of a misnomer. It doesn’t mean “covered for absolutely everything, no matter what.” Instead, it refers to a *bundle* of different insurance policies that, together, offer much broader protection than liability alone.

This typically includes your state-mandated liability, plus:

- Collision Coverage: This pays for damage to your own car if you hit another vehicle, an object (like a tree or pole), or if your car rolls over. It covers repairs or the actual cash value of your car, minus your deductible, regardless of who is at fault.

- Comprehensive Coverage: This is for “non-collision” incidents. Think theft, vandalism, fire, natural disasters (hail, floods), falling objects (a tree branch!), or hitting an animal.

- Uninsured/Underinsured Motorist (UIM) Coverage: This is a lifesaver! It covers your medical bills and car repairs if you’re hit by a driver who has no insurance or not enough insurance to cover your damages. I always recommend this one – it’s often overlooked but incredibly valuable.

- Personal Injury Protection (PIP) or Medical Payments (MedPay): These cover medical expenses for you and your passengers, regardless of who caused the accident.

The “Shah Rukh” Take on Full Coverage:

Years after my old sedan, I got my first brand-new car. It was a big financial commitment, and the thought of anything happening to it made my stomach churn. I knew right away I needed more than just liability. Finding cheap full coverage auto insurance seemed daunting at first, but after exploring a few options online, I realized the peace of mind was worth every penny. And believe me, when a rogue shopping cart rolled into my door in a parking lot, comprehensive coverage saved me a significant repair bill!

Pros of Full Coverage Insurance:

- Extensive Protection: Covers damage to your own vehicle and often your own medical bills, regardless of fault.

- Peace of Mind: Reduces financial stress after an accident, knowing your car is covered.

- Lender Requirement: Often mandatory if you have a car loan or lease (this is why it’s the best car insurance for financed cars).

- Ideal for New Vehicles: Protects your significant investment.

Cons of Full Coverage Insurance:

- Higher Premiums: It costs more than liability-only, sometimes significantly.

- Deductibles: You’ll still pay a deductible out-of-pocket before your collision or comprehensive coverage kicks in.

Who Might Benefit from Full Coverage?

- Drivers with New or Valuable Cars: You want to protect your investment.

- Drivers with Car Loans or Leases: Your lender will almost certainly require it. This is why it’s the best car insurance for financed cars.

- New Drivers: Especially full coverage insurance for new drivers can be crucial, as their lack of experience often puts them at higher risk for accidents.

- Drivers with Limited Savings: If an unexpected car repair bill would be a financial hardship, full coverage offers a vital safety net.

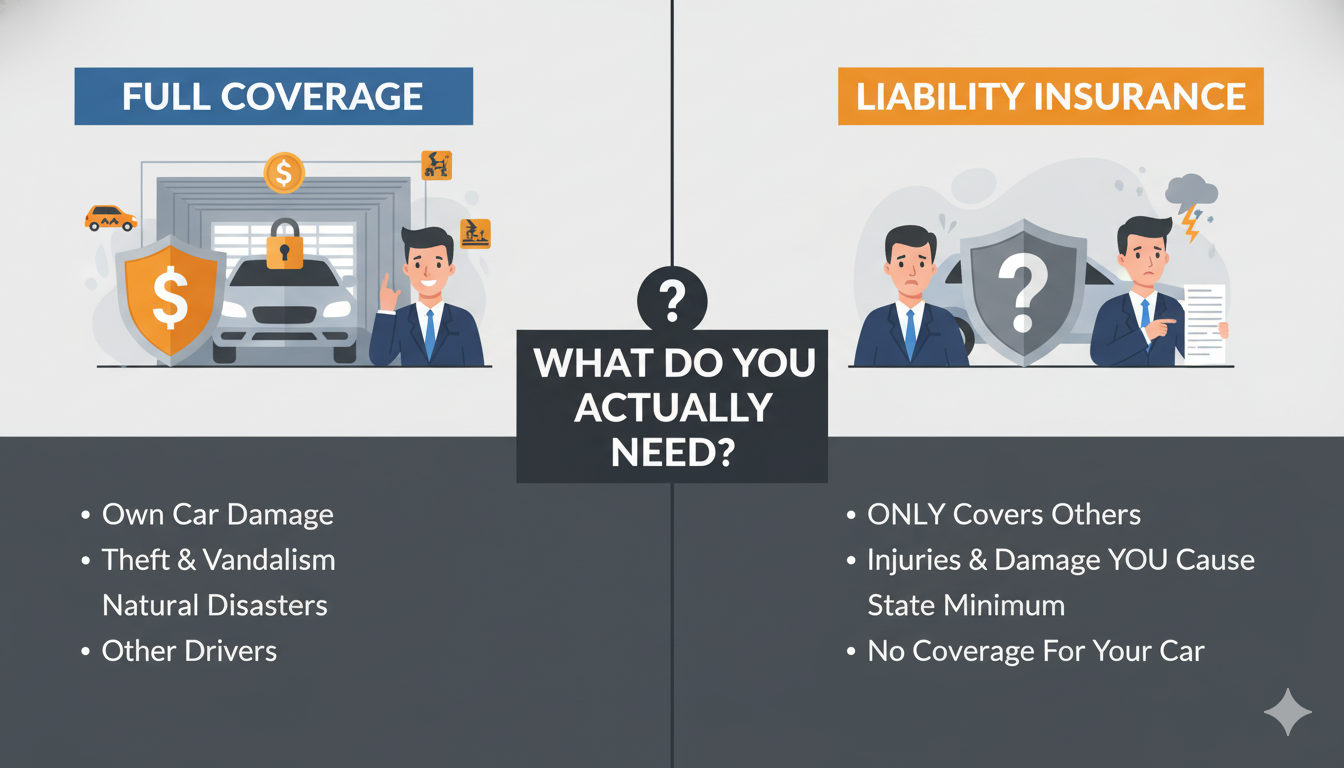

Full Coverage vs. Liability: A Quick Comparison

To make things super clear, here’s a side-by-side look:

| Feature | Liability Insurance | “Full Coverage” Insurance |

|---|---|---|

| Covers Damage to Your Car (at fault) | ❌ No | ✅ Yes (Collision) |

| Covers Damage to Your Car (non-collision) | ❌ No | ✅ Yes (Comprehensive) |

| Covers Damage to Other People/Property | ✅ Yes | ✅ Yes |

| Covers Your Injuries (at fault) | ❌ No | ✅ Yes (PIP/MedPay) |

| Covers You Against Uninsured Drivers | ❌ No (unless added separately) | ✅ Yes (UIM/UM) |

| Premium Cost | Lower | Higher |

| Typical Use Case | Older, low-value cars; strong financial cushion | Newer, valuable, or financed cars; less savings |

So, What Do YOU Actually Need? Practical Tips for Your Decision

There’s no single “right” answer for everyone, and that’s okay! Your perfect policy depends entirely on your unique situation. Here are the key questions I encourage you to ask yourself:

1. What’s the Value of Your Car?

- Low-value car (under $3,000-$5,000): Is the annual cost of full coverage (collision and comprehensive) more than 10-15% of your car’s value? If so, it might not be worth it. Consider liability.

- High-value or new car: You’ve invested a lot. Full coverage is almost certainly a must.

2. Do You Have a Loan or Lease on Your Car?

- If yes, your lender will *require* full coverage. Period. This is non-negotiable until the car is paid off. Looking for the best car insurance for financed cars? It’s always full coverage.

3. What’s Your Financial Cushion?

- Can you easily afford to replace your car out-of-pocket? If you could write a check for a new vehicle tomorrow without blinking, liability might be an option.

- Would a $5,000 repair bill crush your budget? If so, full coverage is a wise investment in your financial stability.

4. How Much Driving Do You Do and What Are Your Driving Habits?

- New driver? Statistically, full coverage insurance for new drivers is often recommended due to higher accident risks.

- Lots of city driving, parking in high-risk areas? Comprehensive and collision become more valuable.

5. What’s Your Comfort Level with Risk?

- Some people are okay with more risk to save money, others prefer maximum peace of mind. There’s no wrong answer, just *your* answer.

Don’t Just Guess: Get Informed and Get Quotes!

The best way to figure out what you need is to see what it actually costs. This isn’t a “one and done” decision. Insurance rates change, and so do your needs!

- Use an instant auto insurance cost estimator: Many sites offer quick tools to give you a ballpark idea without full personal details.

- Get car insurance quotes online: This is the most powerful step. In just a few minutes, you can compare car insurance rates 2025 from multiple providers side-by-side for both liability-only and full coverage options. You might even find some surprisingly good deals on low down payment full coverage insurance.

- Review and switch: Your insurance needs aren’t static. It’s smart to switch car insurance companies 2025 or at least get new quotes every year or two, especially if you’ve had a life change (new car, new address, changed marital status, improved driving record).

The beauty of the online world is that finding information and comparing options has never been easier. Don’t let the jargon intimidate you. You’ve got this!

My Final Thoughts (From Shah Rukh to You)

Choosing between full coverage and liability isn’t about picking the most expensive or the cheapest option. It’s about making an informed decision that aligns with your personal finances, your vehicle’s value, and your peace of mind. It’s an act of self-care for your future.

Don’t be afraid to ask questions, read the fine print, and explore your options. You deserve to feel confident and secure every time you hit the road.

Now that you’re armed with this knowledge, take the next step. Use an instant auto insurance cost estimator and start to get car insurance quotes online. Empower yourself, and drive safely!